Summit County Real Estate Market Update January 2026

Mid-January 2026 | Looking Back at 2025

As we move into 2026, the residential real estate market in Summit County tells a story that is both familiar and nuanced. At first glance, 2025 looks like a year of modest price growth paired with a meaningful rebound in sales activity. A closer look at the data, especially when separating new construction from resale properties, reveals a much more interesting picture.

Below is a breakdown of what we are seeing countywide and within individual market segments, using the attached RE/MAX Properties of the Summit charts and annual statistics.

Big Picture: Sales Up, Prices Mostly Flat

As 2025 wrapped up, December sales finished 6% higher than December 2024, contributing to a 9% increase in total year-end residential sales across Summit County. At the same time, the average sold price increased just 1% year over year, signaling that buyer demand returned in force, but without reigniting the rapid price acceleration we saw earlier in the decade.

Key countywide metrics from the year-end residential real estate data include:

Total residential closings: 1,312 (+9%)

Average sold price: $1,508,023 (+1%)

Average days on market: 78 (+18 days)

List-to-sold price ratio: 97% (unchanged)

Current Inventory: 422 active listings, only 4 more homes than at this time last year

The takeaway: buyers had more options and took more time, while sellers generally needed to price realistically to achieve successful outcomes.

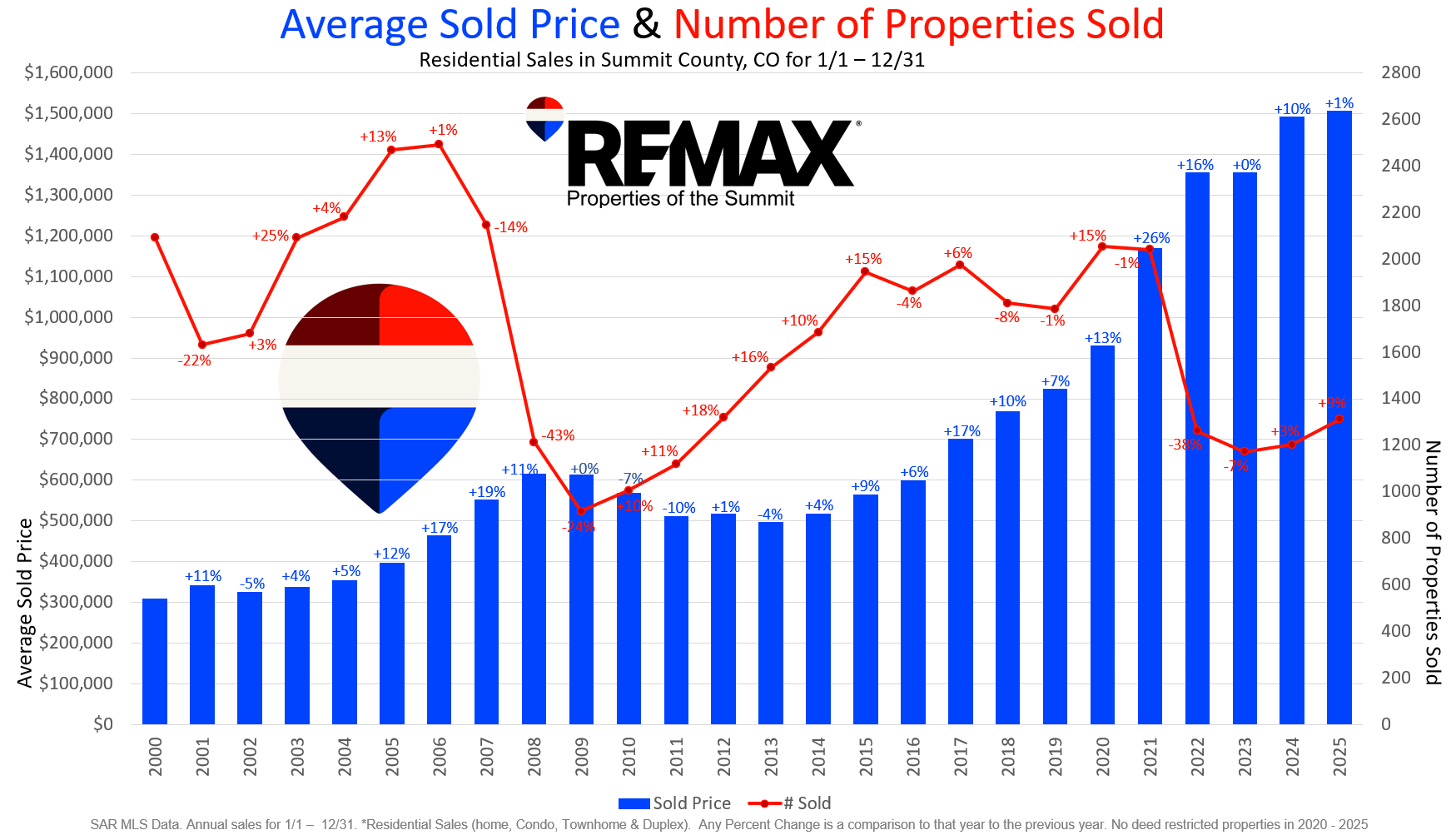

A 26-Year View: Context Matters

Looking at the long-term chart covering 2000–2025 residential sales, 2025 fits squarely into a normalization phase rather than a downturn.

Total sales volume: up 9% year over year

Average sold price: up 1%

After the sharp volatility of the post-COVID years, the market is behaving more like a mature resort market again. Demand remains strong, but buyers are selective and value-driven.

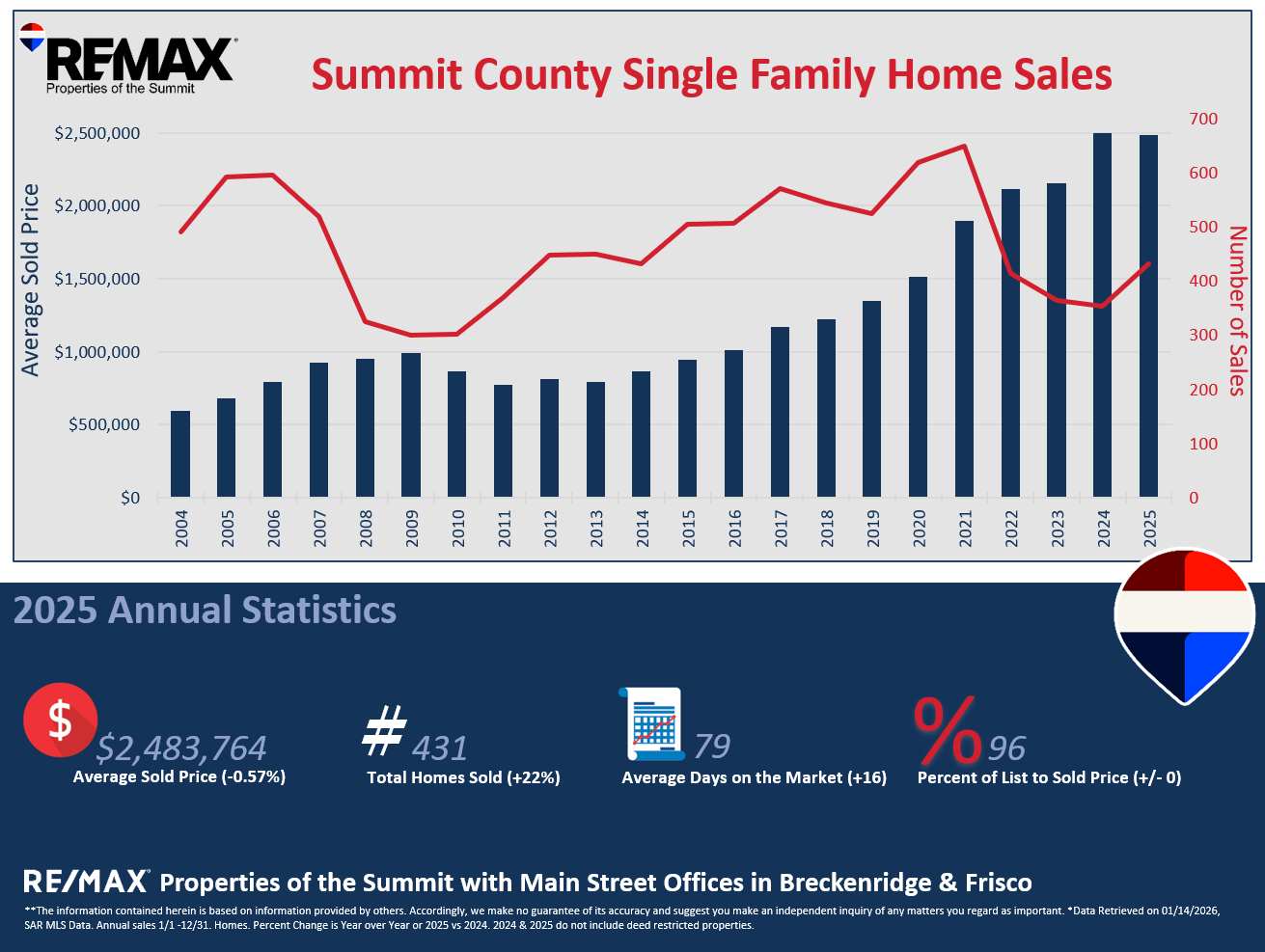

Single-Family Homes: More Sales, Slightly Lower Prices

Single-family homes were one of the most surprising segments in 2025.

Sales volume: up 22%

Average sold price: $2,483,764 (down ~1%)

Average days on market: 79 (+16 days)

List-to-sold price ratio: 96%

At face value, rising sales paired with declining average prices might seem contradictory. However, the data is heavily influenced by a small number of outlier transactions.

A Closer Look at Outliers

Dillon included a $7M sale in 2025. Removing that transaction drops the average price increase to just 0.5%.

Keystone included a $7M sale in 2025 and a sub-$1M sale in 2024. Removing both outliers results in an average price increase of only 0.2%.

What this tells us is that single-family home values were largely flat in real terms, while buyer activity increased substantially. Well-priced homes continued to sell, but buyers showed little appetite for overpaying.

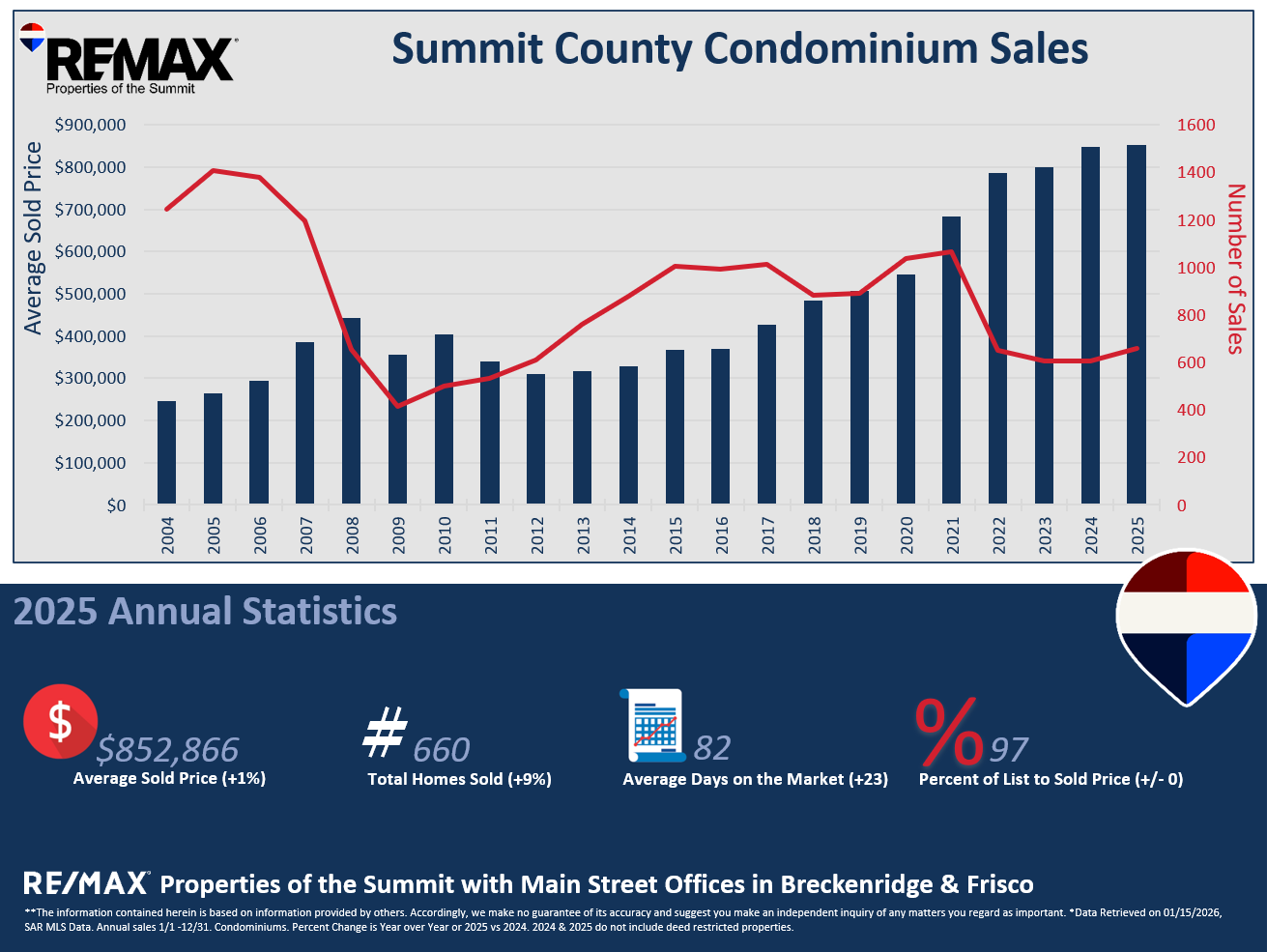

Condominium Market: Sales Up, Prices Mixed

Condominiums remain the backbone of Summit County’s sales volume, particularly for second-home buyers and short-term rental investors.

Total condo sales: 660 (+15%)

Average sold price: $852,866 (+1%)

Average days on market: 82 (+23 days)

List-to-sold price ratio: 97% (unchanged)

Despite the modest countywide price increase, performance varied significantly by town.

Areas with Softer Pricing

Breckenridge: −2%

Dillon: −13%

Frisco: flat

The New Construction Effect (and Why It Matters)

Much of the apparent strength in certain submarkets was driven by new construction, which can significantly skew averages.

Frisco

Sales surged in 2025 almost entirely due to new development.

Without new construction:

Sales: down by 1 transaction

Average sold price: down 16% in the resale market

Silverthorne

Even with new construction included:

Sales: down 25%

Removing new construction from both 2024 and 2025 tells a very different story:

Average resale price: ~$650,000 in 2025

Price growth: +12% year over year

Sales decline: −16%

Keystone

Despite new construction sales:

Average price: up just 1%

Removing new construction:

Sales: down 6%

Prices: down 4%

The consistent theme here is that new construction props up headline numbers, while resale markets are behaving more conservatively and realistically.

What This Means Heading into 2026

As of mid-January 2026, the Summit County market appears balanced and healthy, but far more segmented than the headlines suggest.

Buyers are active, informed, and patient.

Sellers need to price accurately, especially in the resale market.

New construction continues to influence averages, masking softness in some resale segments.

Inventory remains tight enough to support values, but not so tight that buyers feel rushed.

For homeowners considering selling, understanding where your property fits within these trends matters more than ever. For buyers, opportunities continue to exist, particularly when looking beyond headline price statistics.

If you’d like a more detailed breakdown by neighborhood, property type, or short-term rental eligibility, feel free to reach out to The BuyBreck real estate team. Local context is everything in a market like Summit County.